Solar Panel Tax Credit 2018 Md

After 2021 businesses can receive a 10 tax credit for installing solar panels.

Solar panel tax credit 2018 md. The itc applies only to those who buy their system outright with cash or with a solar loan and you must have enough income for the tax credit to be relevant. Maryland increased our renewable portfolio standard rps target of 25 percent renewable energy by 2020 to 50 percent by 2030. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. In addition to the maryland specific solar programs you can cut the cost of your solar energy system by 26 percent through this credit on your income taxes. The residential energy credits are. In 2019 governor larry hogan proposed the clean and renewable energy standard cares that sets the state on a path to 100 clean electricity by 2040 with zero carbon emissions.

Solar energy world stays on top of the latest local solar incentives for you so that you don t have to worry about missing out. Maryland solar incentives continue to save the average homeowner nearly 2 000 in the first year and the federal government will also give you a tax credit equal to 26 of what you pay for solar in 2020. These instructions like the 2018 form 5695 rev. Use these revised instructions with the 2018 form 5695 rev.

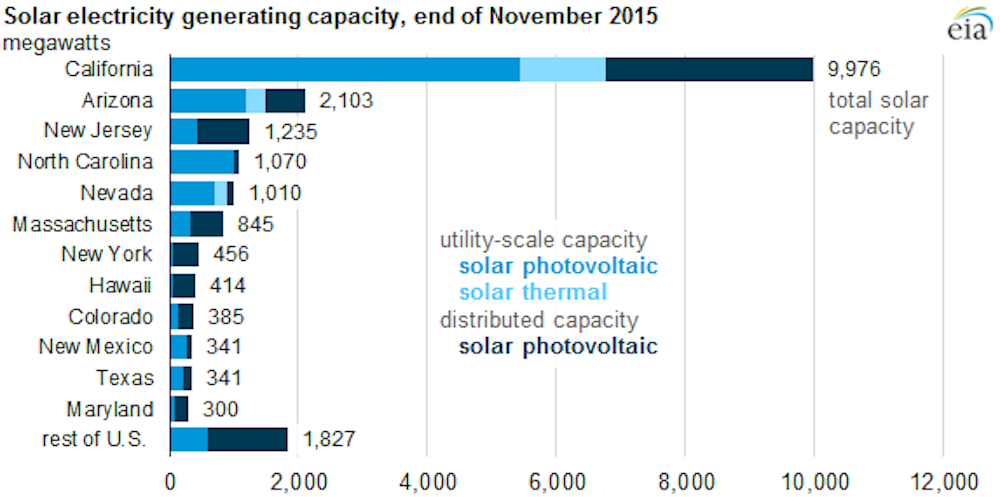

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. Maryland has quadrupled our solar energy capacity from 258 megawatts to 1 000 megawatts. To take advantage of the energy storage tax credit program homeowners must install the battery at their primary residence during the 2018 tax year january 1 2018 to december 31 2018. Any unused portion of the credit may not be carried over to the next taxable year.

2 5 00 5 00 0 credits. The incentive is structured as outlined above in item 2 of the general terms and conditions of this announcement and in the maryland energy storage income tax credit program documents in accordance with the annotated code of maryland article tax general 10 719 and code of maryland regulations comar 14 26 07. One year property tax credit of up to 50 of your.