Solar Rebates In Ny

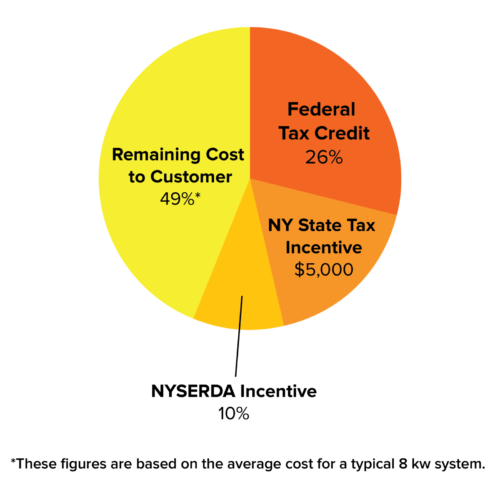

Federal tax credit state tax credit federal solar tax credit.

Solar rebates in ny. The solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use. Building owners who place a grid connected solar energy system into service from january 1 2014 to january 1 2024 are eligible for a four year tax abatement of 5 per year of the installed cost of the system for a total of up to 20. New york solar incentives tax credits. At the end of 2020 the amount of the credit will decrease from 26 to 22 of the cost of the solar installation.

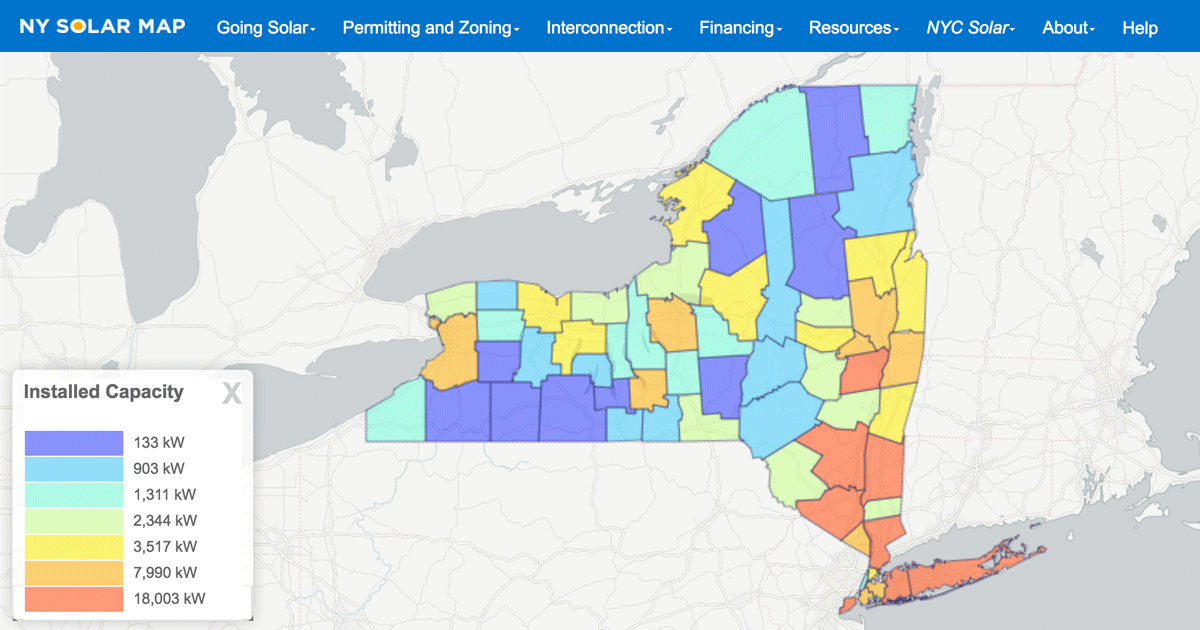

The most significant incentive to install solar panels for homes and businesses is the federal solar tax credit. On top of that intrinsic incentive new york has established an aggressive state rebates program for solar which will refund 1 750 per installed kilowatt hour up to 12 500 or 40 percent of the installed cost of your solar project. Ny sun works directly with solar contractors and developers to offset the cost for new york residents to go solar. Solar is exempt from property tax and sales tax.

New york city property tax abatement pta. The program provides an up front dollars per watt w rebate for both commercial and residential solar panel systems. Ny sun makes going solar easier and more affordable for new york residents. We offer incentives and financing options to lower the cost of purchasing and installing solar at home.